24+ Mortgage borrowing ratio

Lender Mortgage Rates Have Been At Historic Lows. Settling a credit card or two can help in several ways and will lower.

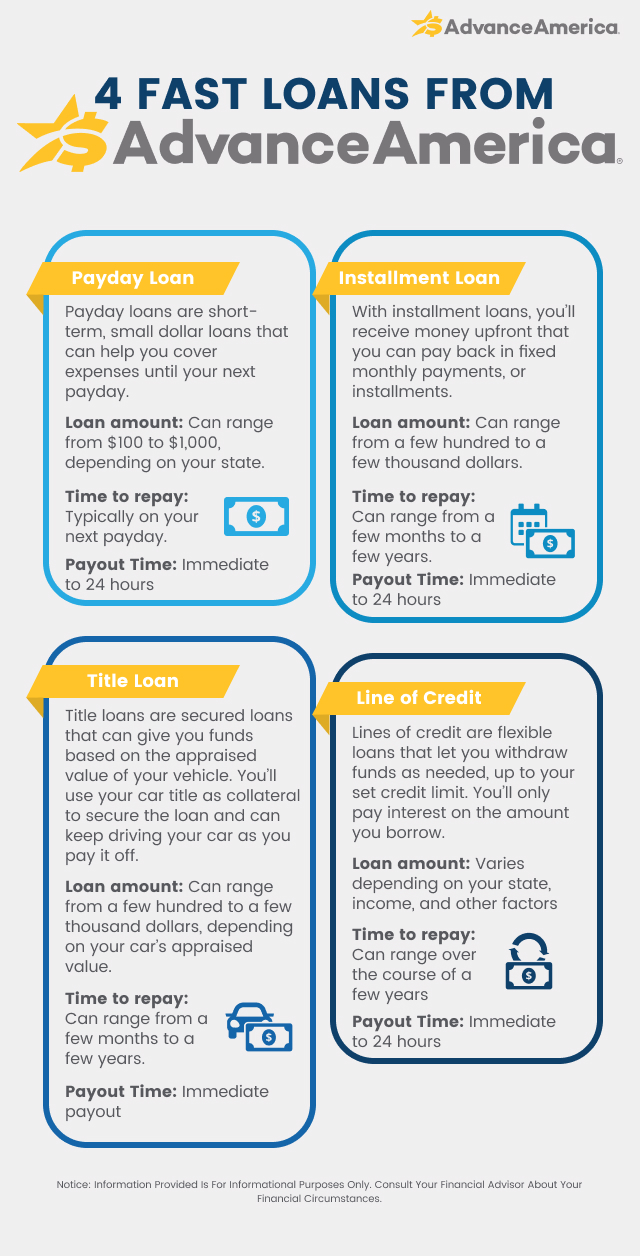

Installment Loans For Bad Credit Advance America

But ultimately its down to the individual lender to decide.

. The average rate on a 30-year fixed-rate mortgage increased to 5916 today up 0028 percentage points from. Explore Quotes from Top Lenders All in One Place. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Ad Learn More About Mortgage Preapproval. The average rate for a 30-year fixed-rate mortgagethe most common type of mortgage in the UShas surged an incredible 24 in the past four weeks alone data from. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

FHAs Office of Single Family Housing. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Take Advantage And Lock In A Great Rate. For example if your monthly pre-tax income is. The more you put toward a down payment the lower your LTV ratio will be.

The debt ratio is a financial ratio that measures the extent of a companys leverage. TOTAL Mortgage Scorecard AcceptApproveRefer - Regardless of the AcceptApproveRefer recommendation by TOTAL. One quick way to be allowed to borrow more for a mortgage loan is to decrease other debts you may have.

The debt ratio is defined as the ratio of total debt to total assets. May 24 2022 10 min read. Total Monthly Mortgage Payment.

You may qualify for a. M onthly payment in the borrowers debt-to-income ratio. When youre trying to take a loan against your mortgage borrow limits.

The debt payment is be included in a orrowers DTI ratio. If you have an extremely low debt-to-income ratio you may be able to borrow as much as 89 percent. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

This ratio compares the amount you hope to borrow with how much the property is worth. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Ad Get the Right Housing Loan for Your Needs.

Browse Information at NerdWallet. As part of an. Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

Non-Borrowing Spouse Community Property State. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Debt-To-Income Ratio - DTI.

Meanwhile Fannie Mae says for manually underwritten loans the maximum total DTI ratio for mortgages is 36 of the borrowers stable monthly income However the. Consent and Authorization. Compare Offers Side by Side with LendingTree.

Begin Your Loan Search Right Here.

Debt To Income Ratio Advance America

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

What Is Financial Literacy Advance America

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

How To Borrow Money Fast Money Loans Advance America

Holiday And Christmas Loans Advance America

How To Get Out Of Debt Pay Off Debt Or Save Advance America

Refinance A Loan Advance America

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Home Improvement Loans Managing Finances

Debt To Income Ratio Advance America

Should I Pay Off My Loan Early Advance America

1

2

2

Revolving Line Of Credit Advance America