Roth ira eligibility 2021

Roth IRAs offer some significant tax benefits but like all tax-advantaged retirement accounts theyre subject to annual contribution limits set by the IRS. 3 In 2021.

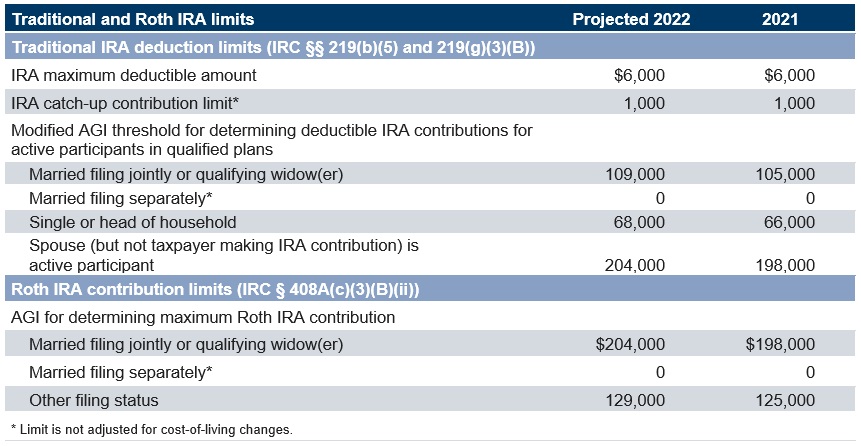

Mercer Projects 2022 Ira And Saver S Credit Limits Mercer

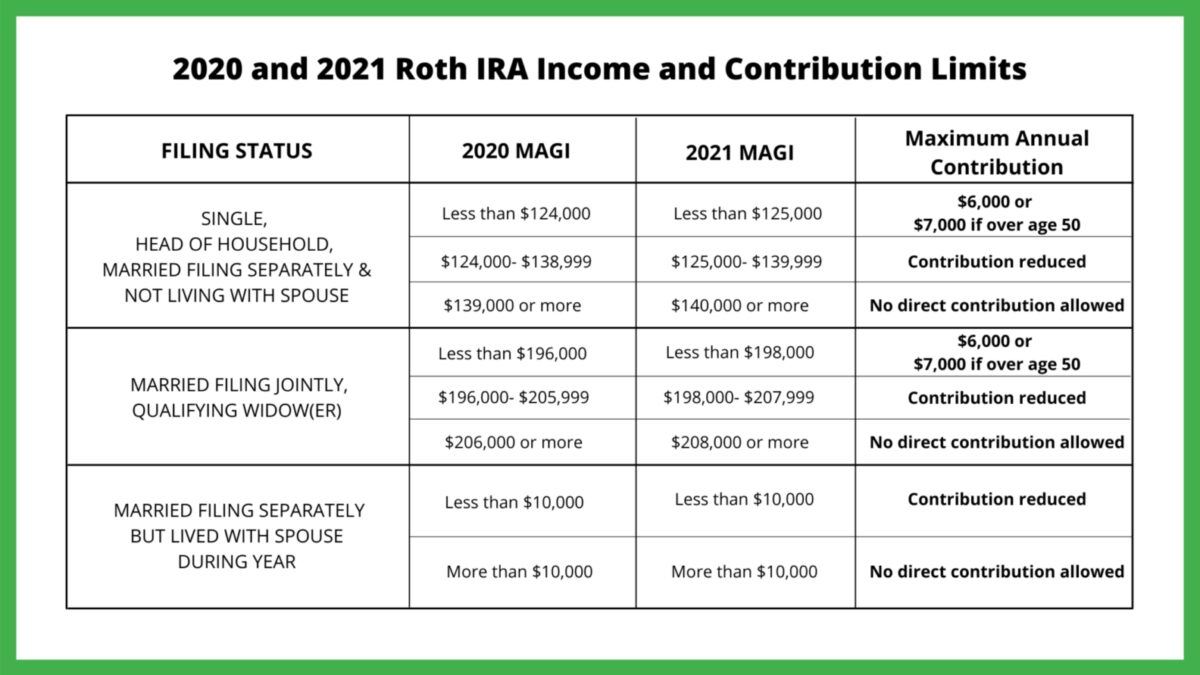

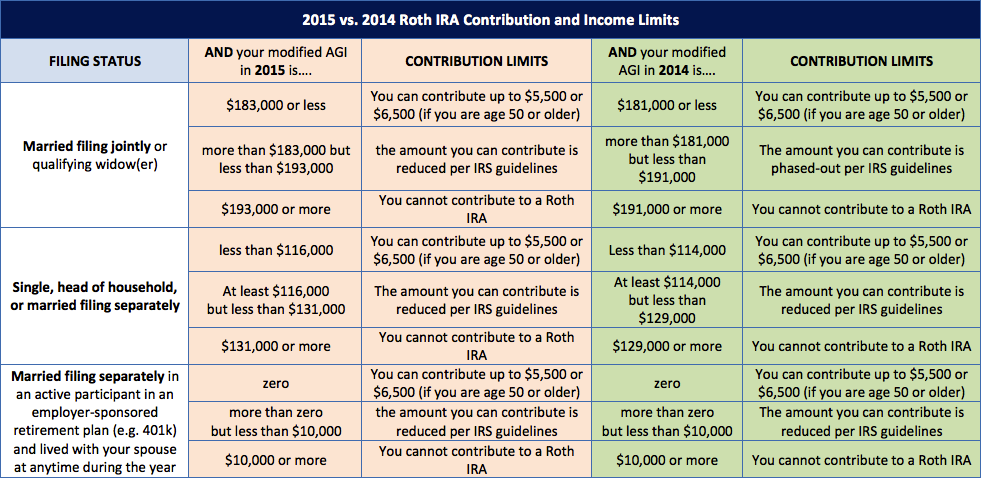

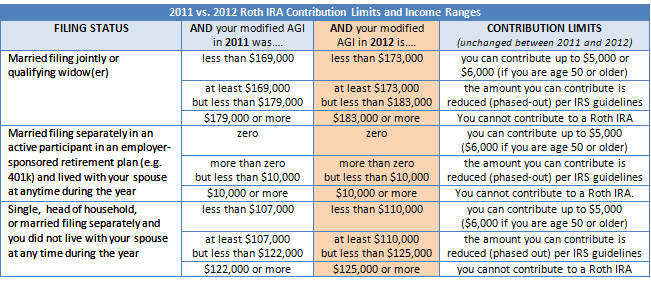

Eligibility to contribute to a Roth IRA phases out at certain income limits.

. Subtract from the amount in 1. Roth IRA conversion is a key way to build tax-free savings but starting 2022 it may get the axe. Pixabay Plus Roth conversion rules 2022 require a more difficult provision applying to any individual or couple with income greater than the thresholds above with defined contribution retirement accounts of more than 20 million and any portion of that amount in a.

A Roth IRA is a retirement account that lets your investments grow tax-free. To the maximum amount if your gross income is less than 129000 for single filers and 204000 for married couples. There are several types of IRAs as.

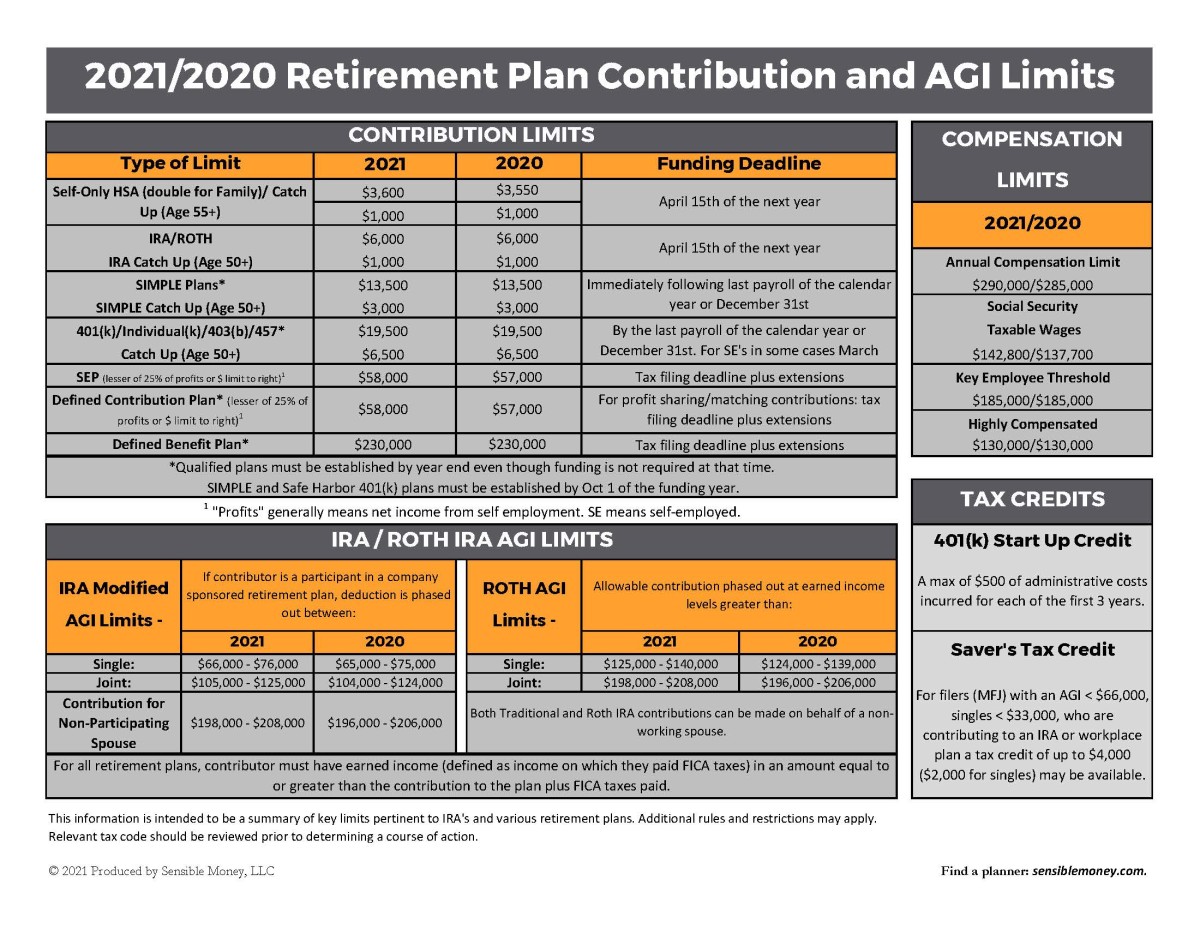

2021-2022 Roth IRA Contribution Limits. You can contribute 6000 for the tax year 2021 and 6000 for the tax year 2022 7000 for tax year 2021 and 7000 for year 2022 if you are at least age 50 or up to 100 of earned income whichever is less. You will face a 6 tax penalty every year until you remedy the.

There are income limitations to open a Roth IRA account. Filing Status 2022 Modified AGI Contribution Limit. What are the eligibility requirements to open a Roth IRA.

As a custodial account the parent that opens the account manages the assets. The maximum amount that you are allowed to contributeyour contribution limitto either a traditional or Roth IRA for tax years 2021 and 2022 is 7000 if youre age 50 or older6000. Roth IRA income requirements 2022.

Married filing jointly or qualifying widower. The contribution limit for 2022 is 6000 the same as for 2021 for both the traditional and the Roth IRA combined. Start with your modified AGI.

Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status. Contributing to Roth IRAs. Your eligibility to contribute to a Roth IRA also depends on how much you earn.

But other factors could limit how much you can contribute to your. Learn about Roth IRA tax benefits along with contribution limits and distribution rules. Modified adjusted gross income MAGI Contribution Limit.

If youre age 50 or older a catch-up provision allows you to put in an. An individual retirement account is an investing tool used by individuals to earn and earmark funds for retirement savings. See which accounts rank as the best.

Individuals under age 50 can contribute up to 6000 for 2021 and 2022 based on Roth IRA MAGI limits. However keep in mind that your eligibility to contribute to a Roth IRA is based on your income level. Eligible individuals age 50 or older within a particular tax year can make an additional catch-up contribution of 1000.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If your income exceeds the eligibility limits good for youbut bad for your ability to open a Roth IRA. Claiming the savers credit.

If you file taxes as a single person your Modified Adjusted Gross Income MAGI must be under 140000 for the. Up to age 50. Up to 125000 to qualify for a full.

Also the fact that you participate in a qualified retirement plan has no bearing on your eligibility to make Roth IRA contributions. The Roth IRA MAGI phase out ranges for 2021 are. The classic 401k plan offered by most employers provides the same tax benefits as a traditional IRA.

Married filing jointly or qualifying widower Less than 204000. The income ranges for these actions all increased for 2021. By contrast contributions to most tax deductible employer sponsored retirement plans have no income limit.

In 2021 and 2022 the Roth IRA. 2022 Roth IRA Income Limits. Although some workplaces offer a Roth 401k option for employees if yours doesnt.

198000 if filing a joint return or qualifying widower -0- if married filing a separate return and you lived with your spouse at any time during the year or. 2021 and 2022 Contribution Limits. The annual Roth IRA contribution limit in 2021 and 2022 is 6000 for adults younger than 50 and 7000 for adults 50 and older.

Individual Retirement Account - IRA. Tax code and for rollover eligibility rules. Determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements.

For 2021 the amount you can. The IRS sets income limits that restrict high earners based on modified adjusted gross income MAGI and tax-filing. 6000 7000 if youre age 50 or older.

Please consult a legal or tax advisor for the most recent changes to the US. Partial contributions are allowed for certain income ranges. 6000 into a separate IRA.

For the 2021 tax year the deadline for Roth IRA contributions is April 18 2022 for most states extended due to the Emancipation Day holiday but April 19 for Massachusetts and Maine due to. Roth IRA Income and Contribution Limits. You can withdraw the money recharacterize the Roth IRA as a traditional IRA or apply your excess contribution to next years Roth.

6000 7000 if age 50 or older. If your child has earned income from a part-time job they may qualify for a custodial Roth IRA. Income Ranges for Determining IRA Eligibility Change for 2021 Internal Revenue Service.

A Roth IRA is an individual retirement account. A Roth IRA is one of the best accounts for growing tax-free retirement savings and it takes just 15 minutes to open one. Open a Roth IRA and take advantage of after-tax benefits as you save for retirement.

A Roth IRA is an individual retirement account that you open and fund directly.

Mercer Projects 2021 Ira And Saver S Credit Limits

These Charts Show How Traditional Iras And Roth Iras Stack Up Against Each Other

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Jumbo Roth Ira Archives Skloff Financial Group

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

Historical Roth Ira Contribution Limits Since The Beginning

Projections For 2022 Contribution Limits Quest Trust Company

Backdoor Roth Ira S What You Should Know Before You Convert

The Irs Increases 2021 Contribution Limits To Sep Iras And Solo 401 K S For Business Owners

Mercer Projects 2022 Ira And Saver S Credit Limits Mercer

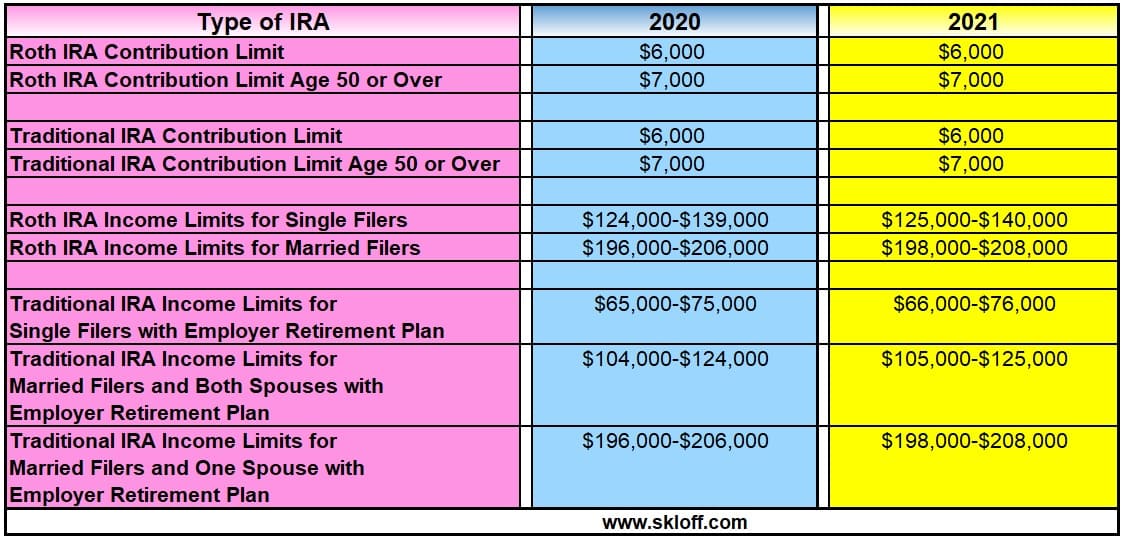

What Are The Ira Contribution And Income Limits For 2020 And 2021 02 01 21 Skloff Financial Group

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2021년 개인 은퇴 플랜 Roth Ira

What Are The 2021 Contribution Limits For Iras 401 K S And Hsas Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Ira Contribution And Income Limits For 2022

Be A Sloth And Don T Roth Why Converting To A Roth Ira Is A Mistake

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest